Blog

How Much Credit Card Debt Do Americans Have? A 2025 Deep Dive

Credit card debt has become one of the most pressing financial issues in the United States. Millions of Americans rely on credit cards to cover everyday expenses, emergencies, and even lifestyle purchases. While credit cards provide convenience and rewards, the reality is that many people struggle to pay off their balances in full each month. As a result, debt builds up — often with high interest rates that make repayment more challenging.

As of 2025, credit card debt in America has reached record levels, crossing $1.2 trillion nationwide. The average household now carries more than $10,000 in balances, and nearly half of cardholders revolve debt from one month to the next. This trend reflects broader economic pressures like inflation, rising living costs, and stagnant wages.

In this article, we’ll explore just how much credit card debt Americans have, who is most affected, why the numbers are rising, and what steps individuals can take to manage or reduce their debt. Whether you’re a cardholder concerned about your own finances or simply interested in understanding the economic landscape, these insights shed light on one of America’s biggest money challenges.

Key Statistics: Total Debt Levels in the U.S.

Credit card debt in the United States is at an all-time high in 2025. Despite efforts by households to cut back on spending or make higher payments, balances continue to climb. Here are the latest figures that show the scale of the problem:

- Total Credit Card Debt Nationwide (Q2 2025): Around $1.21 trillion, according to Federal Reserve and financial research reports.

- Average Credit Card Debt per Person: Approximately $6,455 as of early 2025.

- Average Credit Card Balance per Household: Roughly $10,767–$10,951, depending on the source.

- Percentage of Americans Carrying Credit Card Debt: Nearly 48% of cardholders revolve a balance from month to month.

- Long-Term Debt Holders: About 56 million Americans have carried credit card debt for at least one year.

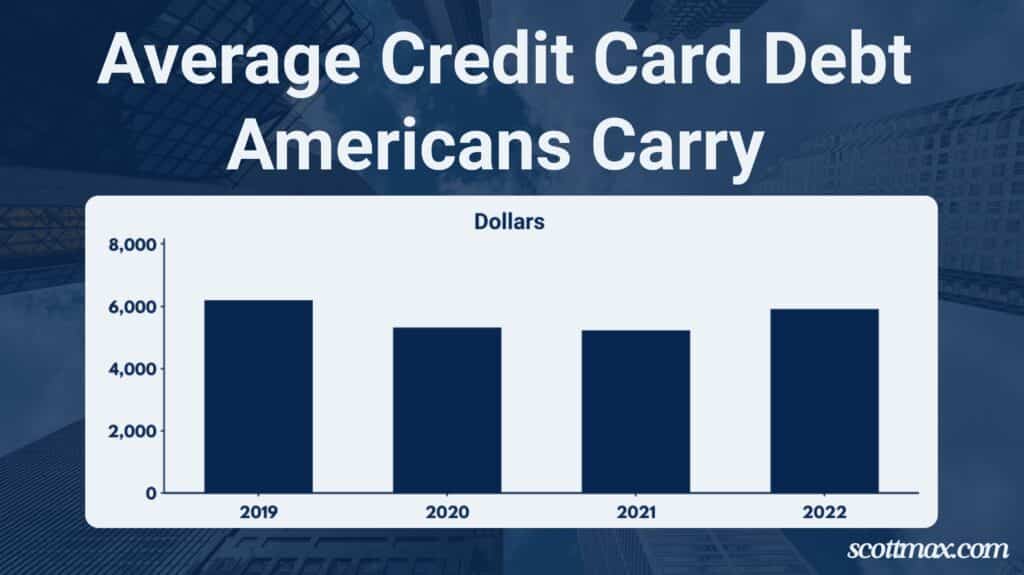

📊 Quick Fact: Credit card balances dipped slightly during the COVID-19 pandemic when people spent less and received stimulus checks. But since 2021, debt levels have climbed steadily, reaching historic highs by 2025.

These statistics show that credit card debt is not just a short-term issue but a systemic challenge affecting millions of American households across different income levels and age groups.

Who Carries the Credit Card Debt?

While credit card debt affects millions of Americans, not all groups experience it in the same way. Factors like age, income, and location play a big role in how much debt people carry and how long they hold onto it.

1. By Generations

- Gen X (ages ~42–57): This group consistently carries the highest average balances, around $9,000+, due to peak family expenses, mortgages, and lifestyle obligations.

- Millennials (ages ~28–41): Millennials average between $6,000–$7,000 in credit card debt, often balancing student loans, rising rent, and childcare costs.

- Gen Z (ages ~18–27): Gen Z has smaller balances, typically under $3,500, largely due to lower incomes and shorter credit histories.

- Baby Boomers (58+): Many Boomers still carry significant credit card balances — sometimes $7,000–$8,000 — often related to healthcare or retirement shortfalls.

2. By Income Levels

- Lower-income households often carry debt as a means of covering everyday living costs, and repayment can take longer because of limited disposable income.

- Middle-income households typically have the largest share of revolving balances, often relying on credit cards for both emergencies and discretionary spending.

- Higher-income households may carry large balances but are more likely to pay them off quickly to avoid high interest charges.

3. By Geography

Debt also varies by state:

- Highest balances: Alaska, District of Columbia, Hawaii, Maryland, and Nevada consistently rank at the top with average balances well above $8,000 per household.

- Lowest balances: Wisconsin, Iowa, Kentucky, West Virginia, and Indiana have some of the lowest average balances, often under $6,000 per household.

4. Long-Term Borrowers

One of the most concerning trends is the number of people who remain in credit card debt for years. About 56 million Americans have had balances for at least 12 months, showing that for many, debt isn’t temporary but a persistent financial burden.

Trends: How Has Credit Card Debt Been Changing?

Rising Total Balances

- As of Q2 2025, Americans carry about $1.209 trillion in credit card debt. LendingTree+1

- That’s up from approx $1.182 trillion in Q1 2025. LendingTree+1

- Over the past four years, since Q1 2021, credit card balances have increased by about $439 billion (a ~57% rise). LendingTree

- In real dollar terms, credit card debt is also now $282 billion higher than the pre-pandemic record (Q4 2019). LendingTree

- Year-over-year growth: balances are about 5.87% above where they were one year earlier. Federal Reserve Bank of New York

Factors Driving the Rise

- Inflation & Rising Costs

Everyday living costs (food, housing, energy) have gone up. As expenses increase, many households use credit cards to cover the gaps. - High Interest Rates on Credit Cards

With higher APRs, the cost of carrying a balance is higher, which means balances grow faster if people make only minimum payments. LendingTree+1 - Credit Card Usage Increasing

More cardholders, more spending on cards (both essential and discretionary). Also, more people are using cards for recurring purchases, rewards, and for convenience. This adds up. clearlypayments.com+1 - Carrying Balances Instead of Paying Off Monthly

A large percentage of credit card holders do not pay off their full balance each month. Carrying a balance (especially with compounding interest) causes debt to rise over time. LendingTree+1 - Credit Behavior & Delinquencies

Delinquency rates (i.e. % of people not making minimum payments on time) have been increasing. When payments are delayed, late fees, penalties, and higher interest charges make debt grow. Federal Reserve Bank of St. Louis+1 - Limited Emergency Savings

Many Americans don’t have sufficient savings for emergencies. So unexpected costs (medical, home repair, job loss) are often put on credit cards. That adds to total balances. (Implicit in trend reports)

Why It Matters

- Interest Burden & Cost of Debt: As balances grow, interest payments take up more of the monthly payment. That means slower progress paying down principal.

- Credit Score Impact: High balances relative to credit limits (high utilization) can hurt credit scores, increasing future borrowing costs.

- Economic Risk: Rising credit card debt can signal financial stress, especially among middle and lower-income households. If too many are late or defaulting, it could affect lenders and broader credit availability.

- Personal Financial Stress: Bigger balances mean more financial pressure, fewer options if income drops or expenses surge.

Slight Decline or Plateauing Household Averages

While total U.S. credit card debt continues its upward march, several data points suggest that average household balances—especially when adjusted for inflation—are either plateauing or showing modest declines. These patterns indicate that some households may be stabilizing or paying down credit card debt, even as macro-debt levels stay high.

Key Findings & Data

- WalletHub Data (Q2 2025): The average credit card balance per U.S. household is about $10,951, which is roughly $2,062 below the all-time record. This suggests household balances are down from their peaks when adjusted for inflation. WalletHub

- Forbes / The Fool (2025): The average household credit card debt is reported at around $9,144, which is notably lower than some previous peak estimates. The Motley Fool

- New York Fed / Household Debt & Credit Report (Q2 2025): Total household debt rose, and credit card balances did increase (by $27 billion from Q1 to Q2 2025, reaching ~$1.209 trillion) but the report notes that non-housing debt (which includes credit card debt) growth has been relatively moderate compared to housing/mortgage debt. Federal Reserve Bank of New York

- Delinquency and Charge-off Rates: These are showing signs of slowing growth or stabilizing in recent quarters, which may correlate with households managing their debts more carefully. WalletHub+2The Motley Fool+2

Possible Reasons Behind the Plateau or Slight Decline

- Inflation Adjustment

When numbers are adjusted for inflation, some of what appears to be growth in nominal debt actually reflects decreased purchasing power. So even if the dollar amount is high, adjusted values may show less growth or slight declines. - Households Paying Down Debt

Some households appear to be making larger payments or paying off credit card balances in full more often, reducing their average balances. - Reduced Discretionary Spending

With rising living costs (food, housing, energy), many households may be cutting back on discretionary spending, thereby preventing further credit card buildup. - Tighter Credit Conditions / Cautious Borrowing

Lenders may be more selective, and borrowers more cautious. Some credit card issuers have tightened credit limits or risk assessments. - Higher Interest Rates Encouraging Faster Pay-downs

As credit card APRs remain elevated, carrying a balance becomes more expensive. This can push people to pay more than minimums to avoid high interest, which over time flattens or lowers average balances. - Balance Transfers / Consolidation

Some consumers may be using balance transfers, 0% offers, or personal loans to move high-interest credit card debt into cheaper instruments, thereby reducing their credit card balances.

Implications from This Trend

- Financial Resilience: A plateau indicates that many households might be avoiding getting deeper into credit card debt despite high interest and economic pressure.

- Credit Score Stability: Lower or stabilized balances often lead to lower utilization ratios, which can help improve or maintain credit scores.

- Pressure on Lenders: If average balances stop rising, credit card companies might see slower growth in interest income from revolving credit. This could lead to changes in fees, terms, or promotional offers.

- Economic Indicator: Plateauing averages may signal that consumers are approaching a limit of what they can safely carry in revolving debt; may hint at slowing consumer spending or tighter household budgets.

What to Watch for Going Forward

- Quarterly reports from the New York Fed and other credit panels for changes in average balances per household.

- Inflation-adjusted debt-per-household numbers to see real growth vs nominal.

- Changes in delinquency/charge-off rates — if delinquencies start rising, average balances may again increase or reflect hardship.

- Consumer behavior surveys about paying off balances vs carrying minimums.

- New credit-card policy shifts (limit adjustments, interest rate changes) that might influence balances.

Delinquency & Financial Stress

📊 National Delinquency Trends

As of Q2 2025, the national credit card delinquency rate stands at 3.05%, a slight decrease from 3.08% in Q1 2025. FRED While this marks the third consecutive quarter of decline, delinquencies remain elevated compared to pre‑pandemic levels, indicating ongoing financial stress among consumers.

👥 Demographic Breakdown

- Young Adults (Ages 18–29): This group continues to experience the highest delinquency rates, with nearly 10% of credit card balances becoming 90 or more days overdue in Q2 2025. Fox Business

- Older Adults (Ages 60+): Delinquency rates decrease with age, with individuals aged 60–69 and 70+ reporting rates of 5.05% and 5.66%, respectively, in Q2 2025. WalletHub

- Income Disparities: Delinquency rates also vary by income:

📈 Underlying Factors

Several factors contribute to the rising delinquency rates:

- High Interest Rates: The average credit card interest rate remains elevated, making it challenging for consumers to pay off balances. Investopedia

- Economic Pressures: Inflation and stagnant wages increase financial strain, leading to higher credit card usage and, consequently, higher delinquency rates.

- Credit Access: Lenders have tightened credit standards, yet a significant portion of new credit card accounts are still being issued to individuals with lower credit scores, increasing the risk of delinquency. Federal Reserve Bank of Boston

🏦 Industry Response

Financial institutions are taking steps to address these challenges:

- Stricter Underwriting: Banks are adopting more conservative lending practices, leading to a decrease in new credit card accounts and a moderation in delinquency rates. Federal Reserve Bank of Philadelphia

- Debt Management Programs: Some institutions are offering programs to assist consumers in managing and reducing their credit card debt.

⚠️ Implications

The persistent delinquency rates signal ongoing financial stress among American consumers. If these trends continue, they could lead to:

- Credit Score Declines: Prolonged delinquencies can negatively impact credit scores, affecting future borrowing ability.

- Increased Financial Hardship: Rising delinquencies may lead to more consumers facing financial instability and potential bankruptcies.

- Economic Impact: Widespread financial stress can affect overall economic stability, influencing consumer spending and economic growth.

Why Credit Card Debt Is So Large & Hard to Manage

There are multiple reasons why many people end up carrying credit card debt — and why it’s sometimes hard to get out of it:

- High Interest Rates

Credit cards often have much higher APRs compared to other types of debt. High interest means the balance grows quickly if you only pay minimums. (Forbes) - Cost of Living & Inflation

Prices for housing, food, energy, transportation — most expenses have increased. When incomes lag behind, people may rely more on credit cards to cover basic or emergency costs. - Emergencies & Unexpected Expenses

Medical bills, urgent car/home repairs, job disruptions — many report that emergencies are one of the main reasons they carry credit card balances. (CNBC) - Paying Only the Minimum

Paying just the minimum balance prolongs debt, increases interest costs significantly, and delays payoff. Many people in credit card debt do this. (Forbes) - Behavioral & Psychological Factors

It’s easier to swipe a card than to think about long-term cost. Impulse purchases, “buy now pay later” attitudes, and not tracking spending contribute. Also, some feel overwhelmed and defer dealing with debt. - Access to Credit & Consumer Culture

It’s relatively easy to get multiple credit cards in the U.S., and many cards offer rewards or conveniences that encourage use. Meanwhile, marketing, social pressures, or lifestyle demands can push spending beyond safe limits.

Consequences of Heavy Credit Card Debt

Carrying large credit card balances isn’t just a number on your statement—it can have wide-ranging financial, emotional, and long-term consequences. Understanding these effects helps individuals make informed decisions about borrowing and repayment.

1. High Interest Payments

- Credit cards often carry APRs above 20%, meaning a significant portion of monthly payments goes toward interest rather than reducing the principal.

- Example: A $10,000 balance at 22% APR with minimum payments can take decades to pay off if no extra payments are made.

- High interest slows down debt repayment and increases the overall cost of borrowing.

2. Credit Score Damage

- High balances relative to credit limits (high credit utilization) can lower your credit score, even if payments are on time.

- Late payments, delinquencies, or defaults have an even more severe negative impact, affecting the ability to borrow in the future.

- Lower scores can lead to higher interest rates on future loans and difficulty qualifying for mortgages, auto loans, or other credit.

3. Financial Stress and Mental Health Impacts

- Carrying large debt can cause anxiety, sleepless nights, and constant financial worry.

- Many Americans report stress-related health issues and reduced quality of life when dealing with prolonged credit card debt.

4. Limited Cash Flow

- High monthly payments reduce disposable income, making it harder to save, invest, or spend on necessities.

- Emergencies or unexpected expenses may push individuals further into debt, creating a vicious cycle.

5. Risk of Defaults or Bankruptcy

- Prolonged inability to pay can lead to default, legal action from creditors, or even personal bankruptcy.

- Defaults negatively affect credit scores for 7–10 years, making future borrowing more expensive or inaccessible.

6. Reduced Financial Flexibility

- Heavy debt limits your ability to make major purchases, invest in retirement, or respond to opportunities.

- Even small changes in income or expenses can become problematic, as debt obligations consume a large portion of your budget.

7. Impact on Relationships and Lifestyle

- Money stress can affect family dynamics, relationships, and lifestyle choices.

- Couples or households carrying large debt often face disagreements over spending and budgeting priorities.

⚖️ Key Takeaway

Heavy credit card debt is more than just a financial burden—it affects interest payments, creditworthiness, mental health, and lifestyle flexibility. Managing and reducing balances proactively is essential to avoid long-term consequences and regain financial freedom.

What Americans Are Saying & Feeling

Credit card debt remains a significant concern for many Americans in 2025. While some express optimism about managing their debt, others feel overwhelmed by rising balances and high interest rates. Here’s a snapshot of the current sentiment:

💬 Public Sentiment on Credit Card Debt

- Financial Regrets: A recent survey by Debt.com revealed that nearly 80% of Americans have at least one financial regret, with 24% citing excessive credit card debt as their biggest regret—an increase from 21% the previous year. Debt.com

- Debt Management Efforts: According to Bankrate, 46% of American credit cardholders carry a balance as of June 2025, down slightly from 48% in November 2024. However, 23% of those with credit card debt believe they’ll never get out of it, with many citing emergency expenses and everyday costs as reasons for carrying debt. LiveNOW

🧠 Emotional Impact of Debt

- Stress Levels: The Federal Reserve Bank of New York’s 2025 Household Debt and Credit Report indicates that 39% of individuals with credit card debt report that their total debt keeps them up at night. Empower

- Regret and Anxiety: Debt.com’s survey also found that 24% of Americans regret charging too much on credit cards, with Millennials (26%) expressing the highest levels of regret. Investopedia

📈 Outlook and Future Concerns

- Anticipated Debt Increase: WalletHub’s 2025 Credit Card Debt Survey revealed that nearly 1 in 3 people expect to have more credit card debt by the end of 2025. WalletHub

- Interest Rate Concerns: A significant portion of the population is advocating for government intervention to cap credit card interest rates, with 83% supporting such measures. WalletHub

🔍 Key Takeaways

- Persistent Debt: A substantial number of Americans continue to carry credit card debt, with many expressing concerns about their ability to pay it off.

- Emotional Strain: The financial burden of credit card debt is contributing to increased stress and regret among consumers.

- Call for Action: There is a growing demand for legislative action to address high credit card interest rates and provide relief to consumers.

Comparison / Breakdown by Demographics & States

The average debt isn’t uniform—some states or groups carry more; others carry less.

- States with higher per person credit card balances: Alaska, District of Columbia, Hawaii, Maryland, Nevada. (Forbes)

- States with lower balances: Wisconsin, Iowa, Kentucky, West Virginia, Indiana. (Forbes)

- Older age groups (like Gen X) tend to carry larger balances than younger ones, in many studies. (The Motley Fool)

Trends to Watch

As of mid‑2025, U.S. credit card debt has reached unprecedented levels, with over $1.21 trillion in outstanding balances. Forbes This surge is influenced by various factors, including increased consumer spending, high interest rates, and economic uncertainties. Here are the key trends to monitor:

1. 📈 Rising Credit Card Balances

- Record High Debt Levels: Revolving credit card debt in the U.S. hit $1.18 trillion in 2025, the highest on record. clearlypayments.com

- Average Balances: The national average card debt among cardholders with unpaid balances in Q1 2025 was $7,321, up 5.8% from $6,921 in Q1 2024. LendingTree

2. 📊 Delinquency Rates and Charge-Offs

- Delinquency Rates: The delinquency rate on credit card loans at all commercial banks was 3.05% in Q2 2025, unchanged from Q1 2025. FRED

- Charge-Off Rates: Credit card charge-offs decreased to 4.29% in Q1 2025, down from 4.54% in the previous quarter. Creditors Bar

3. 💳 Consumer Behavior and Financial Health

- Credit Card Usage: 46% of American credit cardholders carry a balance as of June 2025, down slightly from 48% in November 2024. Bankrate

- Financial Health: More than half (53%) of U.S. credit card customers are currently carrying revolving debt, and 56% are classified as financially unhealthy. jdpower.com

4. 🏦 Lending Practices and Credit Access

- Underwriting Standards: Tightened underwriting criteria have led to a net decrease in total credit card accounts and balances, contributing to improved delinquency rates. Federal Reserve Bank of Philadelphia

- Credit Access: The subprime share of large bank credit card originations has been falling, with the share of accounts originated to low credit score borrowers currently at 16.4%, compared to 23.3% in the first quarter of 2022. Federal Reserve Bank of Philadelphia

5. 📉 Economic Factors Influencing Debt Trends

- Interest Rates: The Federal Reserve’s interest rate hikes have led to higher borrowing costs, impacting consumers’ ability to manage credit card debt. Financial Times

- Inflation: Persistent inflation has eroded purchasing power, leading to increased reliance on credit cards for everyday expenses. Financial Times

6. 🆕 Emerging Credit Products

- Buy Now, Pay Later (BNPL): BNPL services have gained popularity, with U.S. BNPL purchases reaching $56.3 billion from January to August 2025. Reuters

- Regulatory Oversight: Despite low delinquency rates, regulators express concern about the lack of reporting and potential consumer protection gaps in the BNPL sector. Reuters

7. 🧭 Public Sentiment and Policy Advocacy

- Interest Rate Caps: 83% of Americans believe the government should put a cap on credit card interest rates. WalletHub

- Debt Management: Despite efforts to pay down debt, nearly 1 in 3 people expect to have more credit card debt by the end of 2025. WalletHub

🔮 Looking Ahead

The landscape of U.S. credit card debt in 2025 is shaped by a complex interplay of consumer behavior, economic factors, and regulatory developments. Monitoring these trends is crucial for understanding the broader financial health of American households and the potential implications for the economy.

What Can Be Done: Ways to Reduce or Manage Credit Card Debt

Managing credit card debt can feel overwhelming, but with a strategic approach, Americans can regain control over their finances. Here are proven methods to reduce debt and prevent it from spiraling out of control.

1. Pay More Than the Minimum Payment

- Always aim to pay more than the minimum to reduce the principal faster.

- Example: Paying only the minimum on a $5,000 balance at 22% APR could take over 25 years to pay off. Paying just a little extra each month drastically shortens repayment time and reduces interest paid.

2. Use Balance Transfers or 0% APR Offers

- Many credit card issuers offer 0% introductory APR for balance transfers or purchases.

- Transferring high-interest balances to such cards can save hundreds or thousands in interest.

- Be mindful of transfer fees and the expiration date of the promotional rate.

3. Create a Realistic Budget

- Track your income, expenses, and spending habits.

- Identify discretionary spending you can cut to allocate more toward debt repayment.

- Budgeting apps can help visualize where money goes and encourage accountability.

4. Build an Emergency Fund

- Even a small savings buffer of $500–$1,000 can prevent reliance on credit cards for unexpected expenses.

- Having cash set aside reduces the chance of accumulating more debt.

5. Negotiate With Credit Card Companies

- Call your card issuer to request a lower interest rate or hardship plan.

- Many lenders are willing to waive fees, lower APRs, or provide structured repayment plans if contacted proactively.

6. Use a Debt Payoff Strategy

a. Snowball Method:

- Focus on paying off the smallest balance first while making minimum payments on others.

- Psychological boost from early wins motivates continued progress.

b. Avalanche Method:

- Focus on paying off the highest interest rate debt first to save the most on interest.

- Ideal for mathematically maximizing efficiency.

7. Avoid Accumulating More Debt

- Resist impulse purchases and only charge what you can afford to pay off.

- Consider using debit cards or cash for daily expenses instead of credit cards.

8. Seek Professional Financial Counseling

- Nonprofit organizations, credit unions, and certified credit counselors can provide guidance.

- Debt management plans (DMPs) can consolidate payments and lower interest rates.

- Ensure counselors are accredited and reputable (e.g., through the National Foundation for Credit Counseling).

9. Monitor Your Credit Score and Progress

- Keep track of your credit utilization ratio, payment history, and score improvements.

- Seeing progress can motivate continued disciplined financial behavior.

Key Takeaway

Managing credit card debt requires planning, discipline, and strategic action. Combining budgeting, targeted repayment strategies, and responsible credit use can significantly reduce financial stress and help Americans regain control over their finances.

Conclusion

Credit card debt in the U.S. is large and growing: over one-trillion dollars in total, with average household balances around $10,000-$11,000. Many Americans are carrying debt from month to month, sometimes for years, often due to emergencies or rising costs and high interest rates.

But it’s not hopeless: with smart planning, making payments above minimums, reducing interest burdens, and controlling spending, many people manage to reduce their debt or avoid serious delinquency. Whether you’re just watching the trends or trying to deal with your own balances, being informed is the first step to financial control.

Frequently Asked Questions (FAQ) About Credit Card Debt in the U.S.

1. What is the average credit card debt in the U.S. in 2025?

The average credit card balance per American who carries debt is around $6,455, while the average per household is approximately $10,951. (LendingTree, 2025)

2. What percentage of Americans carry credit card debt?

About 48% of cardholders carry balances from month to month, according to recent surveys. (Bankrate, 2025)

3. How does credit card debt affect my credit score?

High balances relative to your credit limit (high utilization) can lower your credit score, even if you pay on time. Late payments or defaults have a more severe negative impact.

4. What is the average credit card interest rate in 2025?

The average credit card APR in the U.S. is approximately 22%, though rates can range from 14% to 30% depending on creditworthiness and card type.

5. What are the main consequences of carrying heavy credit card debt?

- High interest payments

- Reduced financial flexibility

- Increased stress and mental health impact

- Potential credit score damage

- Risk of defaults or bankruptcy

6. How can I reduce my credit card debt?

- Pay more than the minimum payment each month

- Use balance transfers or 0% APR offers

- Create and stick to a budget

- Build an emergency fund

- Negotiate lower interest rates with card issuers

- Consider debt payoff strategies like snowball or avalanche

7. Are younger Americans more likely to carry credit card debt?

Yes, Millennials and Gen Z tend to carry smaller balances than Gen X, but they are more likely to experience stress and regret related to credit card use.

8. Can credit card debt be forgiven or discharged?

Credit card debt can only be discharged through bankruptcy, which has long-term consequences for your credit. Otherwise, balances must be repaid either in full or through negotiated plans with creditors.

9. What should I do if I’m struggling to make payments?

- Contact your credit card issuer to discuss hardship programs

- Seek advice from certified credit counselors

- Avoid accruing new debt while focusing on repayment

10. How does credit card debt impact the U.S. economy?

Rising credit card debt can signal financial stress among households, affecting consumer spending, savings rates, and economic growth. Widespread delinquencies may also impact lenders and credit markets.

Discover more from Mithu Tech Group

Subscribe to get the latest posts sent to your email.